Mumbai

L&T Finance Holdings announces financial results for the quarter ended June 30, 2021

- PAT at Rs. 178 Cr in Q1FY22, up 20% YoY (Rs. 148 Cr in Q1FY21)

- Covid Impact in April’21 & May’21 due to partial lockdown restrictions; successfully deployed Covid 1.0 learnings to counter Covid 2.0

o Top priority accorded to Employee care

o Strengthened Balance Sheet: Created additional provisions of Rs. 369 Cr in Q1FY22; Total additional provisions currently at Rs. 1,403 Cr (1.75% on standard book) to protect against impact of Covid 2.0

o Analytics based collections: Significant increase in Q1FY22 collections of Rs. 13,166 Cr (vs Rs. 4,321 Cr in Q1FY21); despite lower collections in May’21

o Focused on “collection led disbursement strategy”: Disbursements up 125% YoY

o Liquidity: Maintained adequate liquidity buffers as a prudent measure in line with evolving Covid situation

- Leading to Improved Delivery on Business Metrics

o Maintained leading position in Rural and Infrastructure Finance

o Reduction in quarterly WAC by 85 bps YoY (7.64% in Q1FY22 vs 8.49% Q1FY21)

o Achieved NIM+Fees of 7.52%

o GS3 at 5.75% Q1FY22; PCR at 65%; NS3 at 2.07%: GS3 reduced to Rs. 4,881 Cr from Rs. 4,939 Cr YoY

o Increase in retailization: Rural + Retail Housing Book at 45% in Q1FY22. Rural book up by 8% on YoY basis

————-

Mumbai, July 16, 2021: The Board of L&T Finance Holdings (LTFH), a leading Non-Banking Financial Company (NBFC), today announced the financial results for first quarter ended June 30, 2021. LTFH being a Core Investment Company (CIC), carries out its businesses through its wholly owned subsidiaries.

LTFH is among the market leaders in Farm Equipment finance, Two-Wheeler finance, Micro Loans and continues to be one of the leading players in financing of Infrastructure sectors like renewables and roads. With a sustainable business model, data analytics led collection and disbursements, and a sharp focus on asset quality, the Company remains committed to building a stable and sustainable organization for its consumers and other stakeholders.

Commenting on the financial results Dinanath Dubhashi, Managing Director & CEO, L&T Finance Holdings, said, “Despite severe impact of Covid 2.0, the learnings from Covid 1.0 held us in good stead in managing short-term challenges and helped maximise positive impact on business metrics. During FY21, LTFH was able to successfully navigate extremely tough conditions and emerge stronger. Our Q1FY22 performance reflects the fact that the Company has built a sustainable business model, one which will enable it to grow in the medium to long-term while dealing with any short-term challenges (including impact of Covid 2.0).”

Key Highlights

In Q1FY22, LTFH utilized its Covid 1.0 learnings to address short-term challenges and maintained focus on building strengths across businesses. The measures sharply focused on shoring up liquidity, strengthening the balance sheet, following an analytics based collections approach, rigorously adhering to our collection led disbursement strategy as well as according top priority to employee care, with vaccination and financial support. These levers helped the Company minimize the downside and maximise the upside basis market drivers, across key business metrics such as Disbursements, Liability management, NIM + Fees and Credit cost. Furthermore, LTFH advanced its retailization (Rural + Retail Housing) strategy to 45% in Q1FY22, a stated long-term objective.

- Disbursements: In Q1FY22, Covid related partial lockdowns in April and May had an impact on a few businesses. With gradual unlock of economy in June, disbursements bounced back, led by faster pick-up in economic activity across Farm Equipment Finance (FE), Two-Wheeler Finance (2W), Consumer Loans (CL) and Infrastructure Finance businesses. Due to slower Industry pick-up, the Micro Loans (ML), Housing and Real Estate Business saw moderate uptick in collections and disbursements. Infrastructure Finance portfolio continued to see strong sectoral performance leading to high collections on account of sell-down and repayments/ pre-payments.

Rural Finance: Our rural franchise continued to remain one of the leading financiers with increased market share in FE.

- Farm Equipment Finance: LTFH established itself as among the leading financiers in this segment with an increase in market share. The business was least impacted due to Covid 2.0 with farm cashflows remaining robust. This quarter saw the highest ever quarterly ‘Q1’ disbursement in the business, up 130% YoY at Rs. 1,357 Cr. (Rs. 590 Cr in Q1FY21)

- Two-Wheeler Finance: In Q1FY22, there was a gradual pickup since unlock, with sales impacted in May’21 on account of dealership closures. However, the business leveraged analytics to increase counter share across select dealers, with disbursements in the quarter up 165% YoY

- Micro Loans: While disbursements were normal in April, there was a severe business impact in May and June, due to restrictions in field movements. In the quarter, the business adopted a calibrated disbursement approach based on on-ground collection trends which led to

Rs. 797 Cr of disbursements

- Consumer Loans: The business-maintained momentum with ~Rs. 100 Cr per month disbursed in Q1FY22. This business is focused on cross-selling to LTFH’s existing customers with good credit history and leverages end-to-end digital service proposition and analytics led sourcing to scale up with a quality book

Housing Finance:

- Home Loan/LAP: In Q1FY22, though business was severely impacted due to widespread lockdown in major city centres, there was an increase in disbursements on YoY basis. The business continued to focus on salaried segment and remained cautious on Self Employed Non-Professional (SENP) segments

- Real Estate: LTFH maintained focus on funding existing projects with no new sanctions during the quarter

Infrastructure Finance:

The business showed robust disbursement momentum post unlock and continued sell-down with Rs. 1,480 Cr disbursed in the quarter. The business continues to see robust performance backed by higher sell-down volumes and refinancing

- Liability Management: Liquidity remained comfortable in Q1FY22 despite pandemic led disruptions, OTR, etc., on the back of proactive measures instituted from Covid 1.0 onwards. The Company has a well-diversified liability profile and also has demonstrated astute treasury management to diversify funding sources at a lower cost of borrowing. The focus on raising low-cost incremental long-term borrowings through desired sources, continued in Q1FY22.

- Reduction in cost of borrowing by 85 bps YoY (from 8.49% in Q1FY21 to 7.64% in Q1FY22); Q1FY22 borrowing cost is lowest ever

- This has led to increase in NIM+Fees to 7.52%

- As of June 2021, the Company maintained liquid assets in the form of cash, FDs and other liquid investments to the tune of Rs. 12,073 Cr

- Highest Credit Ratings: A diversified business presence, strategic importance to L&T, strong resource raising ability and adequate capitalization resulted in LTFH and all its lending subsidiaries’ long-term ratings being rated ‘AAA’ by all four rating agencies:

- CRISIL – May 2020 and December 2020

- CARE – October 2020

- India Ratings – September 2020

- ICRA – September 2020

Subsequent to the merger of L&T Infrastructure Finance Company Ltd. and L&T Housing Finance Ltd. into L&T Finance Ltd. (L&T Finance) becoming effective, all the Rating agencies have reviewed the ratings of L&T Finance and have assigned / reaffirmed the ‘AAA’ rating in April’21.

- Focus on Strengthening Balance Sheet: From FY19, LTFH started building macro-prudential provisions for any unanticipated future events which held the Company in good stead. Continuing this focus, as a prudent measure LTFH created additional provisions of Rs. 369 Cr in Q1FY22, with this carrying total additional provisions of Rs. 1,403 Cr (1.75% of standard book). These provisions are over and above the expected credit losses on GS3 assets and standard asset provisions. The GS3 in absolute terms stood at Rs. 4,881 Cr in Q1FY22, remaining almost stable on YoY basis. In percentage terms, the GS3 and NS3 assets of the Company stood at 5.75% and 2.07% respectively with PCR on Stage 3 assets at 65%.

| (Rs. Cr) | Q1FY21 | Q4FY21 | Q1FY22 |

| Gross Stage 3 | 4,939 | 4,504 | 4,881 |

| Net Stage 3 | 1,553 | 1,377 | 1,691 |

| Gross Stage 3 % | 5.24% | 4.97% | 5.75% |

| Net Stage 3 % | 1.71% | 1.57% | 2.07% |

| Provision Coverage % | 69% | 69% | 65% |

- Focused Lending Book: The share of retail portfolio in the overall book grew to 45% in Q1FY22, with the rural book growing 8% YoY. While the rural book remained resilient, a calibrated approach in select portfolios led to a reduction in the overall book. Farm Equipment finance book grew 27% YoY and Two-Wheeler Finance by 8%. The asset size of our salaried home loans portfolio also grew by 5% in the same period.

Our Focused Book witnessed robust collections of Rs. 13,166 Cr in Q1FY22 (vs Rs. 4,321 Cr in Q1FY21 and Rs. 13,880 in Q4FY21), despite lower collections in May’21.

| (Rs. Cr) | Q1FY21 | Q1FY22 | Book Growth (%) |

| Focused Lending Business | |||

| Rural Finance | 27,476 | 29,659 | 8% |

| Housing Finance | 26,954 | 22,809 | (15)% |

| Infrastructure Finance | 39,276 | 33,290 | (15)% |

| Total Focused Book | 93,706 | 85,758 | (8)% |

| Defocused Businesses | 5,173 | 2,682 | (48)% |

| Total Lending Book | 98,879 | 88,440 | (11)% |

In the Investment Management business, overall AUM has increased from Rs. 60,056 Cr in June’20 to Rs. 76,552 Cr in June’21, up 27% YoY, on account of higher inflows in pure equity and hybrid category.

- Financial Performance

The Covid second wave did impact business on account of restrictions and closures of dealerships, etc. Despite this, the Company’s collection led disbursement strategy backed by concerted on-field efforts as well as data analytics led prioritization and resource allocation led to responsible growth in Q1FY22.

- PAT of Rs. 178 Cr in Q1FY22 vs Rs. 148 Cr in Q1FY21

- Additional provisions of Rs. 369 Cr in Q1FY22: with this carrying total macro-prudential provisions of Rs. 1,403 Cr (1.75% of standard book)

- Reduction in quarterly WAC by 85 bps YoY (7.64% in Q1FY22 vs 8.49% in Q1FY21)

- Achieved NIM+Fees of 7.52%

o GS3 at 5.75% Q1FY22; PCR at 65%; NS3 at 2.07%: GS3 reduced to Rs 4,881 Cr from Rs. 4,939 Cr YoY

o Significant increase in Q1FY22 collections of Rs. 13,166 Cr (vs Rs. 4,321 Cr in Q1FY21); despite lower collections in May’21

o Increase in retailisation: Rural + Retail Housing Book at 45% in Q1FY22

Mr. Dubhashi further added, “Through FY21, as well as in Q1FY22, the company has agilely adapted and calibrated its approach by leveraging on its business strengths. The month-on-month uptick in collection efficiencies post unlock in the last quarter is a result of our concerted efforts and in recent past we have shown our ability to quickly turn around the disbursement volumes as macro factors open up. Our inherent strengths allow us to remain prepared for any short-term disruptions, including those arising from a potential third wave of Covid. We remain steadfast in continuing to be of service to our customers and helping finance their livelihoods and aspirations.”

About L&T Finance Holdings (LTFH):

LTFH (www.ltfs.com) is one of India’s leading Non-Banking Financial Company (NBFC) that offers a range of financial products and services across rural, housing, infrastructure finance and mutual funds, through its wholly owned subsidiaries. L&T Financial Services (LTFS) is the brand name of L&T Finance Holdings and its subsidiaries. Headquartered in Mumbai, LTFH has been rated AAA — the highest credit rating for NBFCs — by four leading rating agencies. Since FY17, LTFS entities have successfully leveraged digital and data analytics to enhance portfolio quality, achieve scale, increase cost efficiency as well as build market leading products offering among the best-in-class turnaround time (TAT), in service of our consumers. L&T Financial Services has been certified as a constituent company in the FTSE4Good Index Series, for its ESG standards. LTFS was recognised as the ‘Socially Aware Corporate of the Year’ in the Business Standard Social Excellence Awards 2019, and was awarded FICCI’s Corporate Social Responsibility Award for “Women Empowerment” for Digital Sakhi, its flagship CSR program.

@LnTFS @LnTFSonline LTFinance L&TFinancialServices

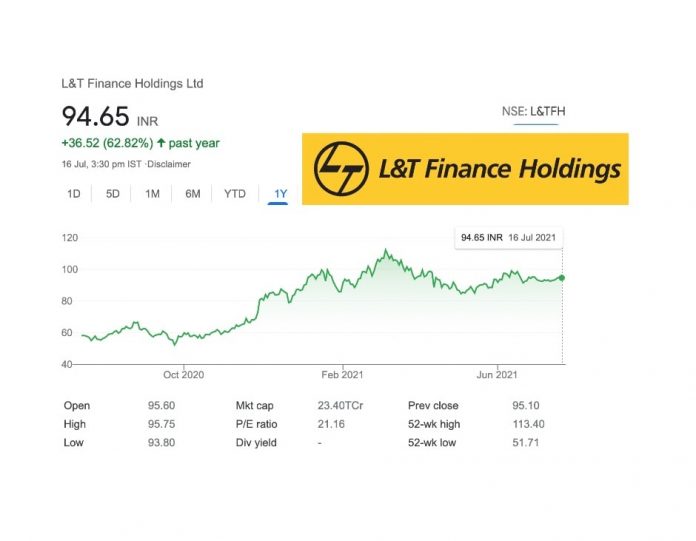

L&T Finance Holdings Q1FY22 results