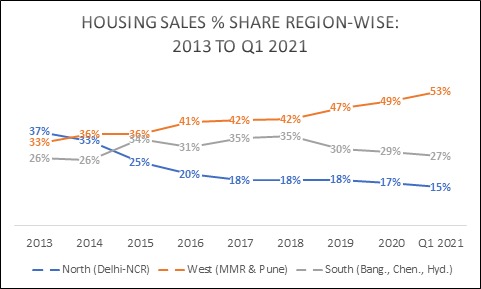

- In stark contrast, Delhi-NCR saw a y-o-y decline after seeing highest sales share among the top 7 cities in 2013

- 2013 saw total housing sales of approx. 3.19 lakh units across the top 7 cities – 37% in Delhi-NCR, 33% in western markets

- In Q1 2021, of total 58,300 units sold in the top 7 cities, MMR & Pune comprised a 53% share while NCR comprised just 15% share

- Sales share of the southern markets Bengaluru, Chennai & Hyderabad remained consistent b/w 26%-35% in the last 8 years

Mumbai, 7 April 2021: In a major trend reversal over the last eight years, the once-most active housing sales markets of Delhi-NCR have dropped sharply in their sales share. The western markets of MMR and Pune are now driving the most housing sales among the top 7 cities, ANAROCK data reveals.

Of a total of 58,300 homes sold across the top 7 cities in Q1 2021, MMR and Pune together accounted for an impressive 53% share, while NCR contributed just 15%. In 2013, of a total of 3.19 lakh units sold across the top 7 cities, the two Maharashtrian cities contributed 33% while NCR comprised the highest share of 37%.

In this period, there were no major variations in overall housing sales share of the primary southern markets Bengaluru, Hyderabad and Chennai whose contribution stayed relatively between 26% to 35%.

Anuj Puri, Chairman – ANAROCK Property Consultants says, “From 2013 to date, MMR and Pune have been consistently ramping up y-o-y sales share while Delhi-NCR saw a decelerating trend. The major factors aiding these western markets included active implementation of MahaRERA and timely government interventions to boost housing demand. Simultaneously, developers here put in determined efforts to bridge the demand-supply gap. In MMR, they did so by launching affordable homes in new areas like Dombivli and Boisar priced within INR 45 lakh. In fact, most leading developers efficiently changed gears to tap the growing budget housing demand.”

NCR continues to pay the price of inordinate project delays and decreased consumer sentiments. The southern markets remained end-user driven and thus maintained an even keel, with developers focusing squarely on consumer demand.

Y-o-Y Sales Share: West Vs Others

- In 2013, approx. 3.19 lakh units were sold across the top 7 cities – NCR comprised a 37% share, the western markets 33% and the primary southern cities 26%

- In 2014, of approx. 3.43 lakh units sold in the top cities, MMR and Pune saw their combined share increase to 36%, whileNCR’s declined to 33%. The southern markets remained at 26%

- In 2015, of a total of 3.08 lakh units sold, the sales share of NCR markets declined to 25%, while that of MMR and Pune remained at 36%. The southern markets saw an uptick with their overall sales share increasing to 34%.

- In 2016, of the total housing sales of approx. 2.39 lakh units, the share of MMR and Pune increased to 41%, while that of Delhi-NCR declined to 20% and that of the southern cities to 31%

- In 2017, of more than 2.11 lakh units sold, the western markets comprised a 42% share; the south cities had a 35% share and NCR accounted for just 18%

- 2018 saw total sales of over 2.48 lakh units, of which the western markets comprised a 42% share, southern cities a 35% share, and NCR at 18%

- In 2019, of over 2.61 lakh units sold in the top 7 cities, MMR and Pune comprised a 47% share, followed by south cities with a 30% share and NCR with a 18% share

- In 2020, of total of 1.38 lakh units sold in the top 7 cities, the two western markets comprised a 49% share, south cities had a 29% share, and NCR saw a further reduction to 17%

- In Q1 2021, of the total 58,300 units sold, MMR and Pune had a 53% share while the total share of NCR markets reduced to just 15%. South cities stood more or less the same at 27%.

SOURCE: ANAROCK

Share of Housing Sales in MMR & Pune Rises Y-o-Y From 2013, 53% in Q1 2021