Magicbricks.com provides a common platform for property buyers & sellers to locate properties of interest in India, and source information about all property related issues. Over the last couple of years, Magicbricks has seized leadership in this fast-growing category through a mix of strong product innovations, a credible content platform, user-insight driven marketing, building of a strong team and importantly, by relentlessly pursuing the vision that Internet will eventually win the lion share in the overall real estate category. At the helm of all this action is Sudhir Pai, CEO – MagicBricks.com. In an exclusive interview with Team Estrade, Sudhir shed light on the state of the Real Estate market in India, government reforms, affordable housing and changing dynamics of consumer behaviour. Sudhir has a vast experience spanning FMCG, Medical Electronics, Banking & Internet sectors. He holds an MBA from the prestigious Symbiosis Centre for Management & HRD (SCMHRD), and a B.E. in Electronics & Telecommunications from Goa University.

- Tell us about magicbricks.com? About your products and services.

Magicbricks.com is India’s No.1 property site. With monthly traffic exceeding 12 million visits and with an active base of over 14 lakh+ property listings, Magicbricks provides the largest platform for buyers and sellers of property to connect with each other in a clear, transparent manner. With this in mind, Magicbricks has innovated several product features, content and research services, which have helped build the largest audience pool.

There are many innovative products that Magicbricks has introduced:

- PropWorth – India’s only app to calculate the price of any property on the go!

- Advice – The objective of this section is to handhold users at every stage of the buying cycle thus helping them make an informed decision and not emotional one. The four main products under this section are: Smart search, compare localities/projects, 9 types of financial calculators and more

- Luxury – The only website to serve a selection of Luxury properties

- Forum – A discussion group where you get answers from your peers as well as experts

- Experience Center – India’s 1st real estate center that uses Virtual reality, augmented realty, large interactive displays etc to bring online and real world’s together.

- Insider club – A club created for buyers that assures them of lowest price guarantee on the properties that they buy.

- MB Premium – This is a bouquet of personalized buying and selling services.

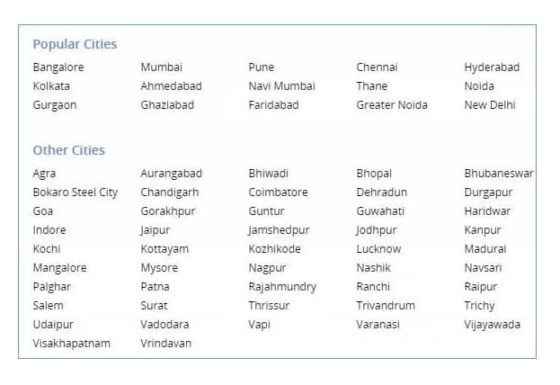

“We garner supply and demand from 60+ cities pan-India”

- com started with an online presence and then moved to television, what prompted this move?

Magicbricks has partnered with Times Network to launch this channel. Our endeavour has always been to make Magicbricks brand ubiquitous across media so as to provide consumers with rich and in-depth information when it comes to matters of property. With this association we leverage the visual appeal of television to communicate our rich data and analytics in an easy-to-consume manner for the consumer. With this launch, we strengthen the offerings and make ourselves available at every touch point to consumers.

- What is the geographical reach of magicbricks.com – both in supply and demand terms? Are you providing products and services to companies abroad?

We garner supply and demand from 60+ cities pan-India. Snapshot of cities is:

- You have access to enormous data on the Real Estate market, what changes do you observe since you started? Do you see any trends, buyer behaviour that you want to talk about?

The internet is influencing consumer behaviour. The consumer of today knows the exact brand and model they want to buy with the help of online research. Online influences more than 70% of all purchase decisions in residential real estate. Moving forward we will see a thrust in the influence by the online channel. Moreover, 75% of the real estate inventory in now available online. As the buying and selling dimensions move online, monetization of online will follow.

There are rapid changes in technology, in consumer expectations and in real estate markets which have led to persistent questions around the future of this business. Especially with increasing technology adoption, there is a deep-dive into the primary tasks performed by the broker. It is a large market with the commissions earned by brokers estimated to be in the range of ~Rs. 14,000cr a year. Brokers operate in all segments of the property market cutting across new projects, resale, rentals, commercial, paying guests, Plots, etc. Thus far, there has been no registration or special qualifications needed for anyone to become a broker, so it was common to see new brokers springing up; while a large number of brokers in the market are 1st generation entrepreneurs, there is a sizeable chunk of brokers who have been in business for several decades.

The landscape in Asia reveals an explosion of real estate development that’s being accompanied by a proliferation of firms seeking to professionalize and optimize operations and cope with the unprecedented growth. The real estate companies and/or organizations with significant real estate holdings face the challenges of a fast-growing operation, building value within the portfolio and complexity.

“Prices in the secondary market have fallen by only 4% at an aggregate level”

- In the Real Estate Sector there are pockets of markets doing well, still, overall the sector has been experiencing a downturn for the past two years or so. Do you see any improvements in the near future? What are you anticipating in the long term?

There has been an insignificant 1% downside in primary market prices, ranging from a 5% dip in some cities to an actual 5% increase in some others. This is unsurprising given the intention of the builder community to hold prices. While there are several projects where developers are running schemes, there is no evidence of any structured fall in prices as yet. Our market intelligence suggests that transactions have fallen, even steeply, in several markets but whether that will lead to any fall in prices is not evident yet.

Prices in the secondary market have fallen by only 4% at an aggregate level (when compared for the post Nov 8 period vs pre-Nov 8). Seen at a city-level, the drop is up to 5% in Bangalore. Landlords therefore seem to be largely holding onto to prices and there is no evidence yet of any knee-jerk fall in prices. In the primary markets, developers have bundled deals to attract buyers and refrained from giving outright cash discounts (so far).

It is noteworthy that in the last 2 years there has been a significant drop in transactions in the primary market; but that led to prices stagnating, but not falling. It is important to watch how trends in the primary market develop since this market, more often than not, also lends direction to the resale market.

“Online real estate classifieds market in India is close to 55-60 Mn US$”

- What is the size of the market you are currently competing in, both in India and the world? Who is your competition?

Online real estate classifieds market in India is close to 55-60 Mn USD during 2015. The industry is still in nascent stages and we expect it reach 215-225 Mn USD by 2020. This is at a robust CAGR of 30%+.

With a robust external online revenue growth of ~55% CAGR over FY11-FY16, Magicbricks has been branded as one of the fastest growing online property portal in the classified market. A proud moment for the company, Magicbricks announced on 30th January, 2017, a remarkable growth of 43% on Rs. 37 crore of the Q3 revenue, holding its ground of delivering a powerful Q3 performance. Our firm also reported YTD FY’17 revenues of Rs. 96.6 crore.

In the property portal segment we are competing with 99acres, which is the next player and then followed by other players like Quikr, Commonfloor, Housing etc. We also compete with FB and Google in digital space. We have no competing products for global audiences.

- Have start-ups significantly influenced the Real Estate transactions in India? Vis-à-vis the traditional route of property brokers, property consultants? Real Estate is after all a big ticket item; buyers take time to finalize a buy.

Brokers operate in all segments of the property market cutting across new projects, resale, rentals, commercial, paying guests, Plots, etc. While the nature of the brokerage business has largely remained unchanged, we have seen recent rapid changes in technology, in consumer expectations and in real estate markets. We feel that property discovery (This relates to a broker being able to find a bunch of relevant properties that match the buyer/renter’s requirements) and logistics (scheduling site visits and appointments, legal paper work, upkeep and maintenance of the property, arranging financing) part of broker’s business have been significantly influenced by technology. The other two aspects of broker’s business like providing hyperlocal advice and match-making/negotiations are still not influenced by technology. No matter how much technology evolves, there’s likely to always remain the need for a personal touch, for the comfort and confidence that an expert provides, for the persuasion skills that a smart negotiator brings on-board.

- Are RERA Act and demonetization major game changers in your business? Will you benefit from these in the long run, like the online payment aggregators have from the recent demonetization?

The inevitable implementation of Real Estate Regulation and Development (RERA) Act, 2016 has led developers to hasten the delivery of their projects. This trend was clearly evident in the quarterly average prices data of Under Construction (UC) vs Ready-to- Move-in (RM) stock, where the premium commanded by RM properties came down due to increase in RM stock, as a portion of UC projects were delivered over the quarter. RERA is a step in the right direction but will bear fruit only in 2-3 years, and till then the Indian real estate sector remains in turbulent waters, and its health can only be gauged through inferential means like pricing and inflation in the sector.

“Keeping in line with the objective of transparency and accountability- the government has strengthened the Benami Act.”

- Which product/service segment is the highest revenue earner for your company?

Majority of our revenues are from builder advertisements and agent listings on the platform. These are the two major sources of our revenue.

- Your views on the Benami Act, how it affects real estate transactions?

Keeping in line with the objective of transparency and accountability- the government has strengthened the Benami Act, which prohibits illegal benami transactions. It automatically brings into the ambit of the government the unaccounted money circulating in the real estate economy. The sector is hence evolving towards achieving an approach that’s more robust and professional towards their customers.

- What are your expectations from the Government for Real Estate? Has the government done enough?

The real estate sector has witnessed dynamic and radical policy and economic development changes in the year 2016. Various game changing reforms were introduced this year, which have impacted the real estate sector, laying a foundation for the future sector-dealings. Real Estate (Regulation and Development) Act, Benami Transaction Prohibition Act 2016 and the Demonetization drive have the potential to revamp the business operations by bringing in transparency. GST will also alter the fortunes of the sector and the players. Besides these, there have been other crucial initiatives undertaken including digitalizing land records and strategizing the sale of land and manufacturing units owned by the government.

- Affordable Housing will really be affordable? Is this just a popularity drive by some stake holders or there is genuine work going on to make housing affordable?

After the recent move of demonetization drive and recent SOPs announced by the Prime Minister in favour of farmers, small entrepreneurs, senior citizens etc. besides housing loan subsidies for the poor– The Indian real estate sector is ready to witness a progressive change.

The much publicized Pradhan mantra Awas Yojana (PMAY) project of the Prime Minister will see some swift action now as much of the required regulatory provisions & changes have happened. This will open up a completely new segment to developers offering huge scales and demand. Assuming a 80% loan component, buyers purchasing a Rs 9 lakh worth home would face an EMI of just Rs 4,752 per month and those buying a 12 lakh home would face an EMI of Rs 6,336. Effectively, for a lot of such home-seekers, the EMI would probably be lower to their current rental outflow and therefore make for a compelling reason to buy vs renting a home.

The reduction in home loan lending rates translates into a ~6% reduction in the EMI of a home-seeker. Bear in mind that interest rates have steadily fallen over the last several quarters, and are expected to fall further as we go along.

- Infrastructure is a major concern and if you see the quality of infra, then the Real Estate prices truly don’t reflect it. What steps do you suggest in terms of policy and funding to improve infrastructure?

As India’s urban population goes up from 26 to 51 % in a decade, the need for upgrading urban infrastructure is most acute here. China has caught up in the past six years. Indian infra requirements include budget housing, road infrastructure, bridges, flyovers and underpasses to connect small towns to cities and then to the metros.

India needs skills, technology infusion, meticulous planning and fast execution. The rot runs deep and experts have recommended that the first step for a long-term solution is to enforce changes in the education system. A lot of pre-cast technology has been implemented in the heavy infrastructure sector which also needs to be implemented in the budget housing sector to ensure quality, speed of construction and to meet delivery schedules.

The biggest requirement is in enabling policies of affordable rental housing to service the migrant populations at different levels. Since this population is extremely mobile and aspirational, they need to be in cities that are safe, well-connected, serviced with food, shopping, entertainment facilities, schools and hospitals. Since Indian city workers normally work through the night to service geographies in North America and Europe, they need effective policing at all times.

“The company further plans to grow by launching a series of new business lines around commercial real estate, the rental segment as well as by integrating products such as home loans, movers & packers and assisted selling services on its platform.”

- What is your vision for Magicbricks, in the near term future and in the Long term?

Magicbricks, as an undisputed Industry leader (Traffic, Listings, Contacts, Revenue and overall customer experience). Our recent ventures such as MB Forum, Prop-worth and Advice not only provide one stop solutions to property purchases but also pride at providing an overall buying experience. Brokers often regard Magicbricks as a user’s paradise owing to the number of easy-to-use products available such as Broker Connect and Smart diary, designed specially to meet their needs.

We are continuously working on building innovative and new products and services to drive usage by further enhancing the buying and selling experience. Apart from this we have also launched a campaign with State Bank of India- ‘Seal the Deal’ which would encourage prospective buyers to invest in real estate. Finally, we shall continue to build products and services that will delight both our consumers and clients. The company further plans to grow by launching a series of new business lines around commercial real estate, the rental segment as well as by integrating products such as home loans, movers & packers and assisted selling services on its platform.

- What is your vision for the Real Estate Industry?

In what has been a largely investor-driven market, now end-user will be the king. The policies and decisions by government will bring in the much required stability and credibility, and transform the sector which will be a stimulus for growth and also boost customer confidence; thus leading to a win-win situation for both in the long term scenario. The year 2017 looks promising as the residential market is expected to pick up in the near future. Given that there have been rate cuts by banks and housing finance companies which ensure relaxation in home loans leading to a higher purchasing parity, one should look forward to a positive real estate market in the coming financial year.

“India needs skills, technology infusion” – Sudhir Pai, CEO – MagicBricks.com