Mumbai, Maharashtra, India: Almost all (91%) Indian midsize business leaders expect their revenues to rise this year, and more than 84% anticipate their profits to climb, according to J.P. Morgan’s inaugural India Business Leaders Outlook survey released today.

Economic outlook for 2023

Economic outlook for 2023

“Even with concerns over rising costs and a competitive business environment, Indian midsize business leaders are strikingly confident about this year,” said Pranav Chawda, Head of Commercial Banking, India, J.P. Morgan. “The survey results help us to anticipate that India will continue on an upward trajectory as businesses explore new and advanced distribution channels internationally, along with forging strategic partnerships and looking for investment opportunities to grow.”

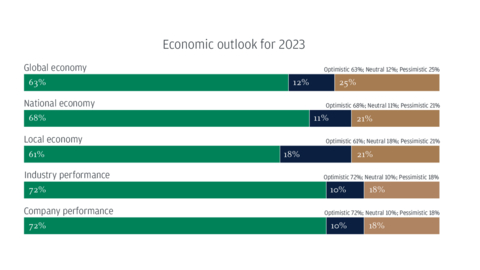

In a survey of more than 300 senior executives from Indian midsize companies, many are confident in the global (63%) and national (68%) economy in the year ahead. Amid the notable optimism, 78% of Indian midsize business leaders are experiencing inflation challenges and rising costs for their businesses—and a large majority expect capital expenditures (76%) and capital needs (82%) to rise, and are therefore scaling their business activities accordingly.

“We are happy to see that the post-pandemic progress is likely to continue in India as midsize businesses are taking the necessary steps to navigate through global recessionary pressures, high inflation, and supply chain uncertainties that will continue this year,” said Kaustubh Kulkarni, Senior Country Officer, J.P. Morgan India and Vice Chair, Asia Pacific.

Establishing Positive Working Environments

With optimism at the forefront, 81% of Indian midsize business leaders expect to increase or preserve their company’s headcount over the next 12 months. Of those planning to add or maintain headcount, they’re combatting the current labor environment and make hiring and retaining strong talent possible by taking some intentional measures through:

- Giving employees flexibility on where they work (64%)

- Increasing wages and benefits (60%)

- Offering flexible work hours (57%)

- Offering upskilling/training opportunities (56%)

Combatting Inflation and Rising Costs

In spite of the local optimism, business leaders are facing challenges and navigating obstacles. Like most businesses across the world, inflation continues to be a major hurdle for Indian businesses with nearly eight in ten (78%) experiencing increased business costs driven by supply chain issues (69%), raw materials (67%) and energy (65%).

To account for inflation, Indian business leaders indicate they are watching prices more closely (53%), making changes to purchasing to reduce expenses (50%), and prioritizing the production, delivery and sale of their most profitable products (49%). Additionally, 61% are passing on up to half of their increased costs to consumers—and almost all (94%) say they will continue to do this in the year ahead.

On a positive note, nearly half (46%) of business leaders sharing that supply chain pressures have improved over the past 12 months. This is generally a result of businesses adding new suppliers from new geographies (55%), allocating more funds to cover increased costs related to moving products (55%), and shifting manufacturing and distribution closer to key markets (51%).

Elevating What Success Looks Like Through Corporate Responsibility

In the year ahead, business leaders have assigned paramount importance to corporate responsibility factors, citing social (74%) and environmental (64%) factors, and diversity, equity and inclusion (64%) as most important to their business strategies.

Top outcomes of these corporate responsibility efforts are rooted in improving employee retention (63%), and enhancing marketing and finding new customers (60%).

Planning for the Future

As Indian midsize businesses prepare for the future, two thirds (66%) plan to introduce new products and services, nearly six in ten (58%) plan to expand into new geographical markets domestically, and more than half (55%) plan to expand into new distribution channels over the next 12 months.

“Indian midsize company leaders’ business transfer strategies range from short-to-medium-to long term,” says Chawda. “Depending on the time horizon, the transfer method ranges from dilution through a Private Equity raise, to going public—and many transferring to family.”

Nearly three quarters (74%) of Indian midsize business leaders are planning or considering a full or partial transfer of business ownership. And of those, the top business transfer method cited is to family or through a gift (32%)—and the majority (91%) expect this transfer to be complete in the next two years.

For more information on the 2023 India Business Leaders Outlook, visit jpmorgan.com/business-outlook-IND.

Survey Methodology

J. P. Morgan’s India Business Leaders Outlook survey was conducted online from November 21 – December 8, 2022. In total, 302 business leaders (CEOs, CFOs, heads of finance, and owners) from Indian midsize companies (annual revenues ranging from 150 Cr – 16,000 Cr) across various industries participated in the survey. Results are within statistical parameters for validity, and the error rate is +/- 5.7% with a 95% confidence level.